The more freelancers you get to know, there’s one similar trait in them you may notice: the ability to pinch a penny. Frugal is the right word here. Every freelancer knows the cheapest items at their local coffee shop (so you can use the WiFi), or have those three low-cost meals they always make (one’s always some bean and lentil soup), or where to find gas that’s a few cents less.

“Well what’s wrong with that?” you ask. “Why shouldn’t I save more of my hard earned money?” Well saving isn’t the problem. Spending less is a good thing. The focus on saving is the real issue for most freelancers.

We save because it’s easy.

Saving is easy. Of course, “easy” is a relative term. Depending on the day of the week, just getting out of bed in the morning is either easy or the hardest thing in the world. Likewise, compared to earning, saving is easy.

Here’s how you know saving is easier than earning more: there are plenty of ways to automate savings. You can auto-deduct from your paychecks to put into a retirement account, or auto-invest into an index fund. Banks have automatic “keep the change” programs that save your pennies when you make purchases. There’s even fantastic accounting software to help you keep track of every cent that comes your way.

If you really wanted to, you could set up all these automated saving methods in a weekend and never have to worry about saving again. Do you want that extra cup of coffee? Too bad, that money is already invested in your 401k and now there’s a penalty to withdraw it early.

But last we checked, there isn’t anything to automate your earnings. If there is a way to sit back and have something earn more for you, please subscribe us to that newsletter.

Freelancers are the most guilty.

Earning more money is hard, but it’s especially hard for freelancers. Most people who work a salaried job can earn more just by longevity. That’s not to diminish how hard they work at all, but it’s fair to say that there are annual raises, annual bonuses, eventual promotions (if only because the person above you leaves), and generally climbing (or being pushed) up the corporate ladder. 9-to-5 employees can increase their earnings just by continuing to do their work, in the same way, at a steady pace.

Freelancing is a different story. You only earn more by hustling more. After all, there are generally just two ways of earning more as a freelancer: increasing the number of hours worked or increasing the hourly rate. Either way, no one’s doing it for you. For the former, you need to put in more work. For the latter, you need to be your own advocate and ask for the higher rate from your clients. For many freelancers, that ask takes more nerves and effort than just working a few more hours. And remember, if you’re an employee, asking for a raise and not getting it just means you don’t get it. For freelancers, asking a client to raise your rate may mean losing that client.

So it’s no wonder why freelancers are focused on saving more than earning more. Earning more is much, much harder. But now you see that the title of this post rings a lot more true. Because hard doesn’t mean impossible. It just means you have to work more. Saving is lazy. Earning is active.

Simple math to prove it’s true.

Let’s start with an anecdotal, classic math example: the cup of coffee. Starbucks, to be more fair, because when personal finance blogs write about how much you can save in a year by cutting out coffee, they mean $5 cups, not the $0.69 cups from a diner.

So a $5 coffee saved everyday for a year is $1,825. That’s pretty good! That’s enough for a new MacBook Pro, which you’ll probably drop because you didn’t have coffee. All kidding aside, that’s a decent amount of money saved. But now let’s look at what happens if you earn just $1 more an hour in a year. If you work 40 hours a week for 50 weeks in a year, that extra dollar an hour nets you $2,000. And if you’re a freelancer, your hourly rate doesn’t go up by just one dollar at a time.

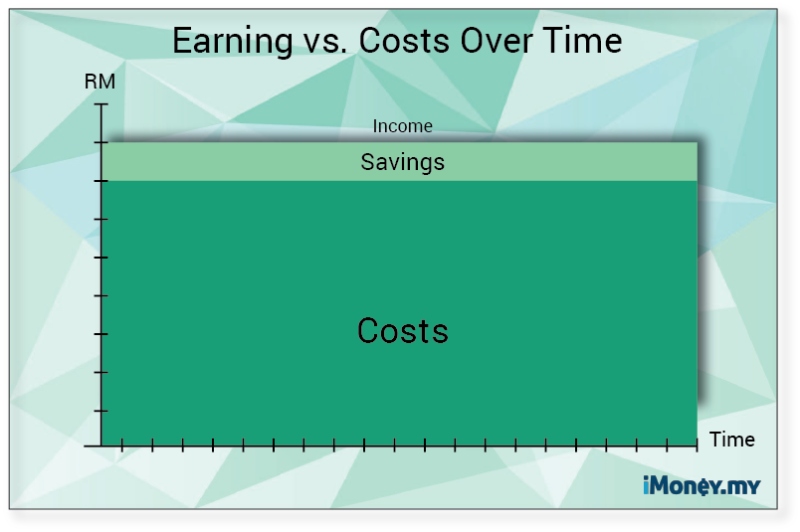

Let’s take a more graphical approach to the idea of saving vs earning. You may have seen charts like this before. These are courtesy of imoney.my:

The chart above shows that since most costs remain fixed (rent, food, insurance, etc), there is only so much you can save when your earnings are flat. The “savings” slice can get wider by pushing down the “costs,” but there’s only so much you can cut. There is a floor, and that floor won’t budge.

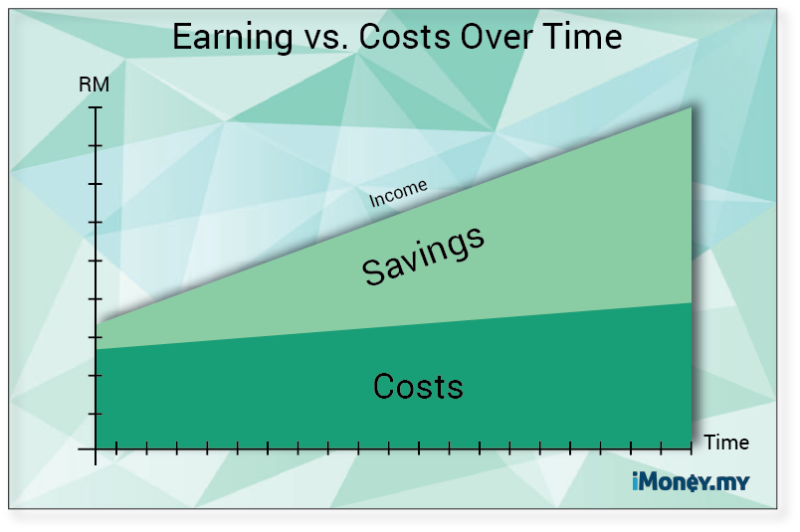

But if you earn more, there is technically no ceiling as shown in the chart below:

Even if your costs increase slightly over time, you’ll be able to save more because you’re not having to push down costs. Rather, you’re raising the ceiling to make more room for savings.

Let’s be realistic about saving and earning.

In real life, of course you should do both. Since saving more is easier, freelancers should think of saving more money as low hanging fruit. Socking away more to your retirement fund, spending less eating out, cutting down on that coffee habit, these are all quick wins to put more money back in your pocket. But mentally compartmentalize these moves as the quick wins they are and move on. You shouldn’t agonize on how to cut another $5 from your daily spend. If you’re going to agonize over anything, it’s how to increase your hourly rate from $30 to $31. It’s just a better use of your stress and effort.

So make sure you have the basics covered:

- A six month emergency fund for living expenses.

- Monthly contributions to a retirement fund.

- Cutting out big-ticket items (ie. downsizing your home, renting out a room, etc.).

- A weekend audit on the smaller places you can save (ie. daily coffees).

Once this is done, automate them so you can stop putting brain power toward saving every dollar and spend those calories on how you can earn more:

- Is it time to raise my rate?

- How can I work more efficiently so I can do more?

- Should I increase the number of clients?

- What other services can I offer?

Yes, figuring out how to earn more is much harder. But freelancers that focus only on saving more are taking the easy route that’s self-limiting. Stop being lazy and stop stressing about pinching pennies when you should be trying to catch dollars.